Key Takeaways:

- Asset allocation is a critical determinant of long-term investment performance.

- Proper diversification can mitigate risk and enhance portfolio resilience.

- Regular rebalancing ensures alignment with financial goals and market conditions.

Table of Contents:

- Understanding Asset Allocation

- The Importance of Diversification

- Strategies for Effective Asset Allocation

- The Role of Rebalancing

- Tailoring Asset Allocation to Individual Goals

- Common Mistakes to Avoid

- Conclusion

Understanding Asset Allocation

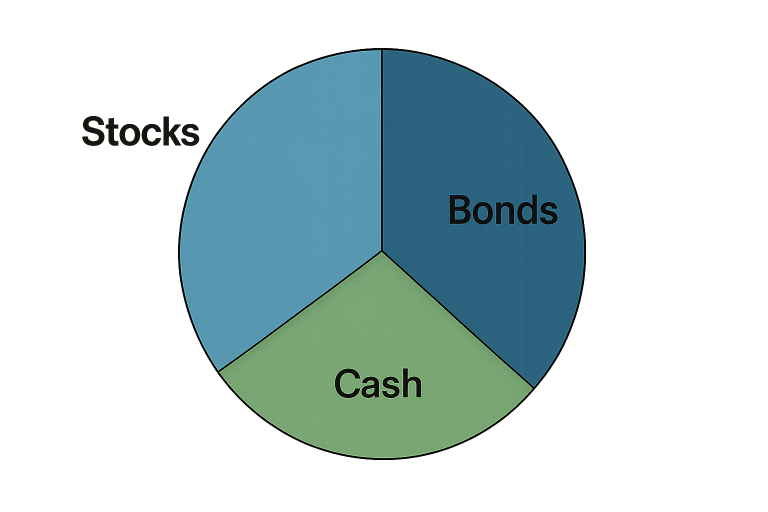

Asset allocation is the strategy of dividing your investment portfolio among major asset classes, such as stocks, bonds, and cash. Each asset class behaves differently in various market conditions, and by spreading your investments across several courses, you can help shield yourself from extreme losses while capturing growth opportunities. This approach is grounded in modern portfolio theory, which emphasizes achieving an optimal balance of risk and return in the pursuit of your financial goals. Learn more about how asset allocation protects your goals and why it’s essential for all types of investors.

By focusing on a diversified allocation, investors not only spread risk but also create growth potential in a long-term investment plan. Annually reviewing and adjusting your asset mix ensures the portfolio reflects your current risk tolerance and financial timeline. This disciplined approach can significantly enhance your ability to weather economic storms and achieve your objectives.

According to a recent article on Investopedia, the majority of a portfolio’s return variability over time can be attributed to asset allocation decisions rather than individual security selection. It’s not about picking the following top-performing stock, but rather anchoring your investment strategy around asset allocation that fits your needs.

As every investor faces periods of market volatility, maintaining a well-considered allocation can help provide consistency and reduce emotional decision-making during difficult times. This is why many experts recommend setting a strategic allocation and sticking with it through both market rises and downturns.

The Importance of Diversification

Diversification is a foundational principle that underscores the importance of not putting all your eggs in one basket. By holding assets with varying levels of risk and return, you can help soften the blow of one segment’s underperformance. For example, when equities face a downturn due to economic turmoil, fixed income, real estate, or even commodities may continue to generate steady returns.

This dynamic works because asset classes often react differently to the same event. While stocks might drop in response to interest rate hikes, bonds could rally, or gold may act as a safe-haven asset. Such interplay helps cushion the overall portfolio, reducing extreme peaks and valleys. Real-world examples demonstrate that diversified portfolios are less volatile, resulting in more predictable progress toward your financial goals. Discover how diversifying your investments can help mitigate risk.

Strategies for Effective Asset Allocation

There are several strategic approaches to effective asset allocation. One widely recognized tactic is the “5% Diversification Rule,” which advises that no single position should account for more than 5% of the total portfolio value. This decreases the likelihood that a single poor investment will derail your long-term performance.

Beyond simple rules of thumb, thoughtful strategies consider your age, investment timeline, and future cash flow needs. Younger investors often prioritize stocks for growth, while those approaching retirement typically seek stability through bonds and cash. Tactical asset allocation enables investors to deviate from their long-term targets in the short term, seeking to capitalize on unique market opportunities or minimize anticipated downside risks.

Risk and Time Horizon in Asset Allocation

Determining the proper allocation often requires striking a balance between risk tolerance and time horizon. If you have a long time before needing your funds, you may select a higher equity exposure to maximize returns. Conversely, shorter horizons call for more conservative positioning, prioritizing capital preservation over aggressive growth.

The Role of Rebalancing

As markets fluctuate, your portfolio can deviate from its intended allocation. For example, if stocks perform exceptionally well, they might grow to represent a larger percentage of your holdings than initially intended. Regular rebalancing—realigning your investments to their original allocation—ensures that you continue to maintain a risk profile matching your plan.

Most experts recommend reviewing your allocation at least once a year, or whenever your mix deviates by more than five percentage points from your original targets. This discipline helps enforce a buy-low, sell-high mentality naturally, preventing you from chasing trends and helping you stay focused on your long-term objectives. For more information on the mechanics and benefits of portfolio rebalancing, refer to this Morningstar guide on portfolio rebalancing.

Tailoring Asset Allocation to Individual Goals

Your chosen asset allocation should reflect your distinct financial circumstances, investment goals, and risk appetite. A young professional saving for retirement can afford to ride out short-term volatility for potentially greater long-term gains, whereas someone nearing retirement is typically more focused on wealth preservation and income stability.

Other factors, such as the need for liquidity, family obligations, or major anticipated expenses, will also shape your approach. As life evolves, so too should your strategy. Regularly reassessing your goals ensures that your asset allocation remains in sync with your aspirations and capacity for risk, ultimately supporting your pursuit of long-term success.

Common Mistakes to Avoid

Even seasoned investors can fall into avoidable mistakes. Over-concentrating in a single asset class, such as technology stocks or real estate, can dramatically raise your portfolio’s risk, exposing you to potentially significant losses from market downturns. Failing to conduct regular portfolio rebalancing may result in a risk profile that doesn’t align with your actual goals or tolerances.

Another frequent misstep is failing to update your allocation in response to changing life circumstances, such as marriage, having children, a new job, or approaching retirement. By staying vigilant and proactively refining your strategy, you position yourself to capitalize on shifting market opportunities while limiting exposure to undue risk.

Conclusion

Asset allocation serves as the compass guiding investors toward their long-term financial goals. By leveraging diversification, adhering to well-defined allocation strategies, and consistently rebalancing, you can better navigate market fluctuations and protect your wealth. As your life and the markets evolve, so should your approach, ensuring your investments continually align with your ever-changing goals and risk preferences.